Actual victims of great energy game between the US and OPEC+ are poorer nations whose economies are under severe stress due to scarcity and high prices. Oil and shipping companies of the Western countries and China are taking full advantage by diverting supplies contracted by poorer countries to Europe for higher profits

by Prasad Nallapati

The OPEC+ decision to cut oil production has infuriated the US Administration, which sees it a favour to Russia to lessen the burden of western sanctions and to hurt President Biden’s electoral fortunes in next month’s mid-terms. The decision to cut two million barrels a day (mbd) accounts to about 2% of the world’s daily oil production. The actual impact, however, is stated to be much lower, about 600,000 barrels to 1 mbd, according to London-based Energy Aspects research firm, as many oil producing countries are unable to pump in to their limits due to sanctions, political instability or technical issues.

Biden Administration is weighing options to punish Riyadh for snubbing its attempts to dissuade Saudi Arabia and its Gulf allies from going for major cuts as there was already global scarcity and consequent price rise due to western sanctions on major oil producing countries like Russia, Iran, Venezuela, etc. President Biden himself traveled to Saudi Arabia in July and his senior officials made frantic last-minute trips to Gulf capitals.

Production cuts have their intended results with crude prices rising to touch $100 a barrel. Thus, easing of Russia’s financial losses while it is waging a war against Ukraine is taken by western countries as a slap on their face as they see the war as a collective defence against Russia’s attempts to break current international order.

US Faulty Policies are reason for Higher Gasoline prices, says Saudis

Saudi Arabia and other bigger oil producers, however, claim that the cuts have nothing to do with political considerations and it is more of an economic decision to maintain stability of oil industry and boost their revenues in the light of projected decline in demand. They point out that the reason for higher oil and gas prices in the US lies in President Biden’s faulty policies like limits on oil and gas production and his non-emergency release of oil from national petroleum stockpile.

According to Wall Street Journal, the administration has released 200 million barrels or so from the Strategic Petroleum Reserve over the past year and about 1 mbd in recent months. These drawdowns were scheduled to end this month, but the administration recently extended the releases into November to avoid increase in gasoline prices before the midterm election. Economists Casey Mulligan and Steve Moore say the Biden Administration’s anti-oil-and-gas policies are costing the US economy $100 billion a year.

It is also pointed out that the high gasoline prices in the US is directly related to decline in its refining capacity as many refineries were closed in recent years due to heavy losses. Such decline in domestic supplies is normally covered with imports. Global scarcity however set limits to such a prospect leading to higher prices in the US.

No Secret that Saudis Prefer Republicans to Biden-led Democrats

No US President has ever been reelected with gasoline prices above $4 a gallon, and the price at the pump is now hovering around that level. Current projections in the midterms are showing that the Senate is swinging back to the Republicans which is a bad omen for Biden’s Democrats.

It is no secret the Saudis prefer Republicans to Democrats. It was the Trump Administration which made Saudi Arabia the fulcrum of its Middle East policy and withdrew from the nuclear accord with Iran.

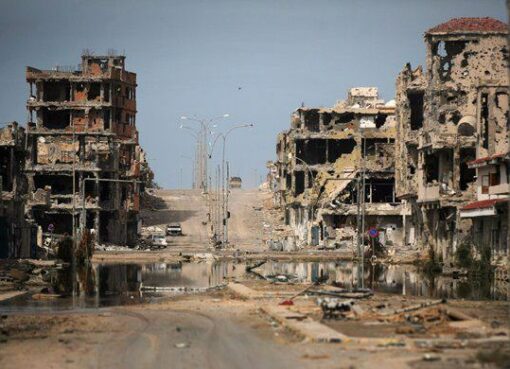

The actual victims of this great energy game between the US and OPEC+ are poorer nations whose economies are under severe stress due to scarcity and high prices. Oil and shipping companies of the Western countries and China are taking full advantage of the situation by diverting supplies contracted by poorer countries to Europe for higher profits.

Diversion of Energy Supplies from Poorer Countries to Europe for higher profits

The US has diverted much of its LNG exports to rich European countries from other poorer nations like India, Pakistan etc., ostensibly to help Europe sustain declines from Russia due to sanctions, but the fact is they fetch higher prices in Europe and hence higher profits. The US exported about 57 bcm of gas as LNG in the first half of this year with 39 bcm or 68% going to Europe. That is compared with 34 bcm or 35% of LNG exports shipped to Europe for all of 2021. That means the US has already sent more gas to Europe during the first six months of 2022 than it did in all twelve months of 2021. Belgium saw its US imports of LNG swell by some 650% while Pakistan saw its US imports decline by 72%. The shippers are willing to pay contractual penalties for failing to deliver to poorer countries.

Europe is thus cushioned from additional supplies not only from the US, but also from China and the GCC countries. Saudis have assured European countries of supplying oil at a discount for winter. The UAE has agreed to supply natural gas and diesel to Germany as part of an “energy security” deal to replace Russian supplies. It’s oil company, ADNOC, began deliveries of diesel last month and supply of 137,000 cubic metres of LNG will be made in December. Qatar also signed agreements with European countries to supply large quantiles of LNG. China, which gets its cheaper oil supplies from the Gulf, Iran and Russia, is also diverting these stocks to Europe thus making huge profits in the process.

It is this nexus between the Western countries, OPEC+ and China that is driving the poorer nations to look for discounted energy supplies from wherever it is available, be it Russia or Iran.

(The writer, a former Additional Secretary to Government of India, heads the Deccan Council for Strategic Initiatives, a think-tank based in Hyderabad)