May be some quarters in Washington, D.C., are trying to take advantage of the current situation to further drive a wedge between the US and India

*Ankineedu Prasad Nallapati

The Adani Group seems to have come under US scrutiny once again, this time for possible violation of American sanctions on Iran. Its prosecutors are said to be investigating whether Adani companies imported Iranian liquefied petroleum gas (LPG) through its Mundra port.

It’s a Wall Street Journal report. There is no confirmation yet from the Department of Justice, the paper said. The Adani group also said it’s not aware of any such investigation and denied “any deliberate engagement” of sanctions evasion or trade involving Iran-origin LPG.

The paper claims to have launched its own investigation into movement of tankers between Mundra and the Persian Gulf and found suspicious activity in April last year.

The ship in question was Panamanian-flagged SMS Bros which was contracted by Adani Global PTE to supply 11,250 metric tons of LPG from Sohar port in Oman to Mundra. The WSJ report, however, said that the ship never appeared to have docked in Sohar’s port but picked up its LPG load at Tonbuk, Iran.

A spokesman for Adani Group said the shipment was handled through a third-party logistics company and documentation shows the cargo as originating from Sohar. “Adani companies don’t own, operate or track vessels and can’t comment on the activity of vessels they don’t control,” he added.

The paper also said that they found three other LPG tankers involved in some “forgery” of documents while making runs between Mundra port and the Persian Gulf.

Impact on Adani companies

The stocks of the Adani Group of companies fell over 2 percent in Tuesday’s trading after the WSJ report.

The damage so far, however, is much limited compared to Hindenburg allegations in January 2023 that saw the group losing 48 percent of share value and the November 2024 bribery case that led to a 20 percent decline. The companies, however, recovered fast.

Timing and Intent of Report Raises Questions

The same paper carried another news item on the same day it published the report on Adanis.

It said the Trump Administration has put on hold indefinitely any further sanctions on Iran and no new designations, even routine ones, have been issued since last two weeks. The pause may be in the context of sensitive nuclear talks underway.

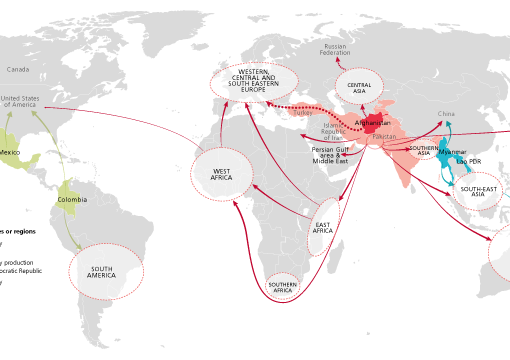

The report further reminds that Iran sanctions intersect with US policy toward China, which takes in more than 90% of the Islamic Republic’s oil exports, with other countries like Japan, Europe, India and Southeast Asia absorbing smaller quantities.

According to Vortexa, which tracks energy cargo, 10 countries received oil cargoes from Iran during the first three months of this year. While the vast majority was taken by the Chinese, small volumes were received by the UAE, India, Pakistan, Yemen, Singapore, Malaysia, Bangladesh, Sudan, and Oman.

China is known to be openly flouting the US sanctions on Iranian energy, most other countries receiving smaller quantities may be buying from third party suppliers, who control the tankers, rather than directly contracting for Iranian energy cargoes.

While two minor Chinese refineries in Shandong province were sanctioned in April for buying Iranian oil, no major investigation was launched into much more serious, illegal transshipments of oil supplies to China, which are well documented.

According to a Bloomberg report, the San Marino-flagged Vani oil tanker is right now heading to Qingdao port in China, the hub for illicit Iranian oil exports.

The vessel had a ship-to-ship transfer of oil from the US-sanctioned Guyana-flagged tanker, Nora, off the eastern Malaysian coast between May 15-20. The Nora sailed from the Persian Gulf. Both the vessels shut off their transponders during the transshipment to avoid detection.

Although President Trump announced on May 1 that any country or person buying Iranian oil or petrochemicals will immediately be subject to secondary sanctions and will not be allowed to do business with the US, his administration has slowed down the “maximum pressure” measures on Iran.

Why then the Indian Adani Group is being singled out by the WSJ report? Is it a deliberate leak from some vested quarters in the administration to bring pressure on Prime Minister Modi and India?

The bribery investigations launched against the Adani Group under the previous administration were effectively closed by President Trump as part of his clean-up of the Department of Justice.

After initial bonhomie between Trump and Modi, new tensions are building up between the two countries over trade relations and changing geo-political equations.

May be some quarters in Washington, D.C., are trying to take advantage of the current situation to further drive a wedge between the US and India.

(*Ankineedu Prasad Nallapati is President of the Hyderabad-based think-tank, “Deccan Council for Strategic Initiatives and former Additional Secretary to Govt of India)